Startups and intellectual property (IP): What tech investors look for

In a tech startup, it is often the value of the intellectual property (IP) assets that the investor finances, the business partner relies upon, or the purchaser pays significantly for. It is critical to have “clean” ownership of any intellectual property (IP) that is critical to the operation and success of the business.

An an entrepreneur, you must have “clean” ownership of any intellectual property (IP) that is critical to the operation and success of the business.

If your business’ products and services depend on certain key IP assets, an investor will undertake due diligence to understand the entrepreneur’s right to use such assets.

Investors and due diligence

In general, an investor needs to make sure that your business owns the intellectual property for your technology idea without any interference or encumbrance from a previous employer, institution, investor or other employees. A thorough due diligence process will entail a review of:

Your prior duties for former employers or other businesses, based on your employment or shareholders’ agreements

New business ideas often emerge while an entrepreneur is working for or has obligations to another business entity.

IP assignments are common in the tech industry and usually indicate that any inventions, ideas, work product or other developments conceived or authored, during the course of the employee’s engagement with an employer, will be owned by the employer.

As a result, if the entrepreneur’s new startup derives in any way from work for a previous employer, the previous employer may have a claim for infringement of their intellectual property rights against the new business.

Entrepreneurs should use care not to work on a startup during work hours or use the resources of the employer as this may provide the previous employer rights to the new business’ IP.

IP rights of academic institutions to inventions and works resulting from academic research

Tech investors will want to confirm that IP rights have been properly assigned to the new startup for its exclusive use. They’ll also review all publications by academic researchers to ensure that public statements have not limited the new business’ ability to obtain patents on the inventions and works.

Potential IP rights of third parties (for example, government agencies)

If third parties have provided funding, these organizations may have certain license rights that could impose a potential limitation on the business.

Patent strategy and proposed patent concepts for the new business

Most tech investors will review patents and patent concepts after signing a specific non-disclosure agreement. This is important for early-stage ventures in particular where patents have yet to be filed.

A white paper describing patent concepts can prove useful for due diligence purposes.

The tech investor may request that the new business undertake some prior-art searches on key proposed patent concepts as part of the due diligence process, making sure that the same (or very similar) concept has not already been patented by someone else.

IP assignment agreements between the startup and its entrepreneurs and early employees

Investors want to ensure that all related ideas, inventions and works have been transferred to the startup from individuals.

Employment agreements with all employees

Investors want to ensure that all inventions, ideas, work product or other developments conceived or authored, during the course of the employee’s engagement with the business, will be owned by the business.

What else will you need to provide to your investors?

At early-stage rounds of financing, legal documents for an investment, contracts for a strategic business partnership, and merger or acquisition agreements contain representations and warranties with respect to intellectual property assets from the new business and often from founding entrepreneurs.

Examples of typical representations include the following statements:

- The startup is the sole owner of the intellectual property

- Except as disclosed, the startup isn’t party to license, lease or other agreement to use the intellectual property

- To the best knowledge of the startup, the startup does not interfere with intellectual property rights of a third-party

- There are no actions, suits or proceedings pending or threatened against the startup claiming that it is infringing any intellectual property rights of others

- To the best knowledge of the startup, no person has infringed on the startup’s intellectual property rights

Entrepreneurs should engage qualified intellectual property counsel at a very early stage of their business to ensure that they have the freedom to operate their business with their inventions and to make certain that the new business can meet the due diligence requirements of investors.

Startups should maintain their focus on intellectual property matters through the entire life of the business.

Note that negligence in protecting IP may also affect strategic partnerships to scale the business and influence the selling price on the exit of the business.

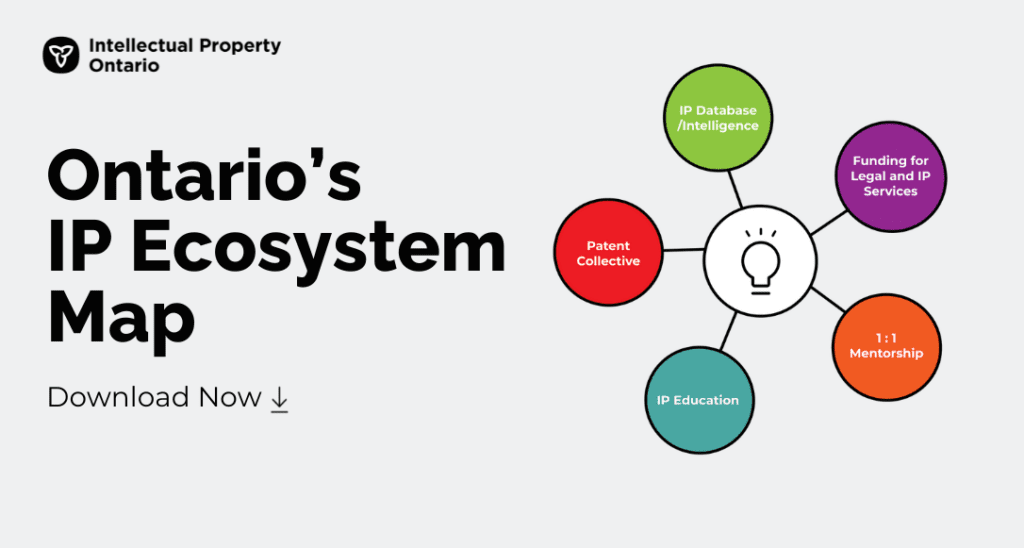

Check out Ontario’s IP Ecosystem Map! Our partners at IPON designed this tool to help guide Ontario innovators & researchers on their IP journey. It’s an interactive PDF with info on IP service providers across Ontario.