Management and its ability to execute

October 27, 2009

We’ve seen some exciting new technologies in the past couple of months and our work to “accelerate the path to commercial success” is intensifying. Of particular interest are some of my clients with waste to energy, solar, water treatment and smart grid technologies. These organizations will be the backbone of the Ontario economy in the not to distant future.

As we work work with these early stage organizations, some patterns are emerging. Clearly, these technology companies are focusing in exciting and growing sectors. They’re based in science and are well on their way to securing IP protection for their inventions. Business models — although initially a little crude — are being re-worked to demonstrate the ability to successfully turn a profit. Any investor who takes a quick look is quickly impressed on all three fronts.

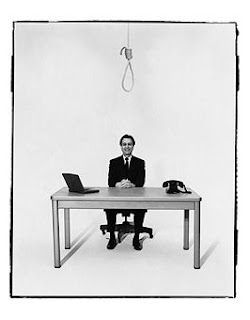

So why aren’t we reading more about the successful financing of these companies by Angels, VC’s, government grants and larger institutions?

A quick canvas of any investor group will tell you that management and its ability to execute often eclipses the process for securing early stage funding. Due diligence teams will ask leadership teams questions such as:

- How many years of experience does the team bring to the table?

- Have you successfully built other organizations to a successful exit?

- Does the CEO have the depth and breadth to move the organization to its next level?

- Are all key functional disciplines appropriately represented by the organization?

- Does the management actually act and respond as an effective team?

- Is the team able to articulate an action plan and deliver those promised results?

- What kind of dashboards are used to track weekly, monthly and quarterly success?

These are extracts of a long list of diligence questions that any investor will need to be comfortable with before opening the cheque book. How about the one that Kevin O’Leary made famous on Dragon’s Den: “What if you get hit by a bus and you’re road pizza?”

The key for these emerging technology companies will be to do a detailed assessment of their team and its story around executing strategy. The assessment will no doubt uncover several holes in the team that will need to be proactively addressed to mitigate investor risk. These may include:

- Identifying key hires that will be added once funding is secured

- Assembling the Advisory Board and ensuring that they are engaged

- Hiring part-time mentors to work with lessor experienced executives

- Encouraging the completion of supplementary training programs

- Joining key sector networking forum

- Identifying that the existing CEO may need to step aside in favour of a “been there, done it before” leader.

The good news for entrepreneurs is that if their technology really is a game changer, the path to profitability is reasonable and the tactics to augment the execution strategy are sound, many seasoned investors will take a serious second look at the company with great result.