How Canada can take advantage of solar energy’s big power play

By MaRS Staff | December 9, 2025

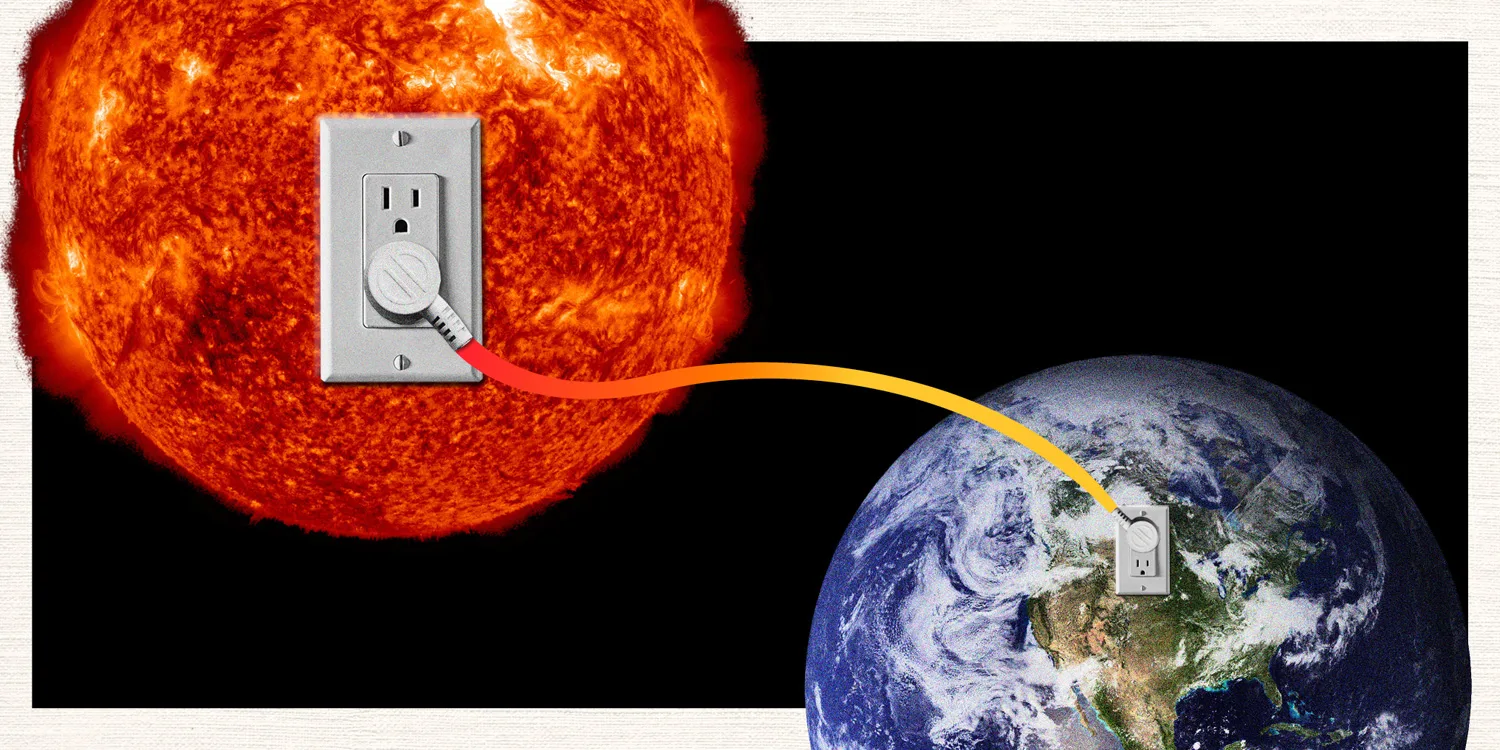

The astonishing, unstoppable, world-changing rise of the sun

Solar energy is having a moment. It’s now the cheapest form of electricity generation in human history, and experts predict it will be the dominant source by 2050. While Canada is falling behind its peers in adopting the technology, we haven’t exactly been sitting on our hands either. Below, we discuss a couple of shrewd local companies that are taking full advantage of the solar surge.

Also, in this week’s newsletter: The year’s biggest funding deals, stories from the ecosystem and the hottest jobs this week

Solar energy takes a star turn

In his latest book, Here Comes the Sun, veteran American environmental activist and journalist Bill McKibben argues that the recent spike of solar power could change everything. Redress financial inequities created by the fossil fuel industry. Reduce competition and conflict. Reconnect us to the natural world. Above all, when it comes to the climate crisis, it could offer us something sorely lacking lately: hope. “Everything is going wrong,” he writes, “except this one big thing.”

In Canada, however, this one big thing is still relatively small. At the end of 2024, there was only 24 GW of solar, wind and energy storage installed across the country, and solar accounted for just 1.1 percent of our electricity generation. In the much smaller Netherlands, it accounts for 16.6 percent. And this past April, wind and solar generated a full quarter of China’s electricity.

Canada hasn’t yet jumped onto the solar bandwagon, because, for the most part, we haven’t felt we needed to. Our energy sector, of course, is synonymous with oil and gas, and when it comes to renewables, well, there’s hydroelectricity — we’re the world’s third-largest producer of hydro.

But with solar now the cheapest way to generate electricity in most places on Earth, what are we risking by not joining this revolution? As the rest of the world rapidly moves away from fossil fuels, how valuable will our oil and gas continue to be? These are thorny questions. But some Canadian companies aren’t waiting for answers and have developed technologies that capitalize on the world’s appetite for cheaper, cleaner power.

Take the Toronto firm Morgan Solar. It recognized that the sun produces too much energy. And, therefore, we spend a lot of effort during the day ventilating and cooling buildings that absorb too much sun, and then heating up those buildings when the sun goes down. Accordingly, the company devised smart window blind systems that convert sunlight into electricity to power the rooms the blinds are in. Those window coverings can now be found everywhere from the C.D. Howe building in Ottawa to Scarborough’s Bridlewood Library. Last year, Morgan Solar won the supplier innovation prize from BGIS, which manages 40,000 buildings around the world. The two companies are now partnering on commercial-scale installations of the tech in various Cisco and BMO buildings.

Another Canadian solar startup, Ottawa-based Enurgen has devised a new way of assessing the energy yields of increasingly complex utility-scale solar plants. Unlike traditional 2D models, Enurgen’s three-dimensional physics-based model gathers, among other things, meteorological data and information about light distribution to gauge precisely how much sunlight is hitting a solar cell and optimize a plant’s output. “When designers, engineers and investors are looking to invest capital in these types of power plants,” says co-founder and CEO Kibby Pollak, “they need a very accurate model.” This year, the company raised U.S.$4.1 million in seed funding to scale its platform.

“You can’t fight the Chinese juggernaut,” says Morgan Solar CEO Mike Andrade. In other words, you can’t compete on building massive solar infrastructure. But what you can do, he argues, is use the momentum that China and other countries have created and find niche applications that take advantage of it: “You just have to intelligently use the existing manufacturing capacity and what other people do well, and then add what you do well to create a product that has attractiveness.”

Can’t get enough sun? On the latest episode of our podcast, Solve for X: Innovations to Change the World, Mike Andrade and other solar experts discuss the past, present and future of the technology. Listen wherever you get your podcasts.

Really big deals: taking stock of the year’s most significant raises

“It’s been a difficult year for fundraising,” says Liam Gill, who leads MaRS’s Capital Program. When investors did open their wallets, it was only for a select few — there were fewer transactions overall as VC concentrated their bets with larger deal sizes. As Gill points out, we’re seeing a shift in mindset, with growing recognition of the need to support more companies working on foundational technologies in sectors such as AI, energy, defence, space, climate, health and critical minerals. “However, for those used to the overnight success of SaaS and AI companies,” he says, “there’s still an adjustment to the longer commercialization and growth timelines for companies in these industries.” Here, a round-up of some of 2025’s biggest cheques (all figures in U.S. dollars).

$215 million

How much Multiverse Computing raised in its Series B round. The Spanish company, which has offices in Toronto and many European cities, is developing quantum tech that lowers the costs of using AI. The round was led by Bullhound Capital, with the support of HP Tech Ventures and others.

$200 million

The amount raised by Toronto-based Hydrostor to implement its innovative compressed-air energy-storage tech at various sites in Australia and North America, including the Quinte Energy Store Centre Project being developed in Lennox and Addington County, Ont.

$122 million

How much AI-powered tax software firm Blue J Legal raised in its series D round of funding, which will be used to accelerate its team expansion, product development and market research. The round was the biggest the company’s closed to date, and was led by American VC firms Oak HC/FT and Sapphire Ventures.

$30 million

The amount secured by Montreal-based cybersecurity firm Flare to accelerate growth and innovation. The round includes a U.S. $15-million Series B extension led by Inovia’s Growth Fund, plus $15 million in debt financing from BMO.

$20 million

How much DealMaker, North America’s largest retail capital–raising platform, raised in a funding round led by new investor Information Venture Partners and existing partner CIBC Innovation Banking. The capital will be used to accelerate the deployment of AI across their product line and capitalize on emerging ownership models across professional and collegiate sports.

$10 million

The amount raised in an oversubscribed investment round by Vive Crop Protection, a Mississauga-based agtech company that leverages nanotechnology to design more effective insecticides and fungal treatments. The round, which includes major new investment from Farm Credit Canada, will help the firm advance its product pipeline and expand market reach.

Stories from the ecosystem

REAL ESTATE: Toronto startup Adaptis ensures buildings don’t end up as landfill.

AGTECH: These Canadian innovators are rethinking how to grow a sovereign food system.

AI: How Handshake’s AI receptionists are helping resource-strapped founders.

CLIMATE: Alberta-Ottawa energy deal could unlock billions in low-carbon investment.

DUAL USE: The Feds pledge $357.7 million to help smaller firms get defence contracts.

Pulse Check: Climate Impact 2025

While the mood at COP30 last month was grim, there’s still a case to be made for climate optimism. In this two-minute video, attendees at this year’s Climate Impact conference share what’s making them hopeful about cleantech.

Upcoming events

- Life Sciences Ontario’s last Knowledge and Networking Breakfast of the year, “Breaking the Cycle: Why Innovation in Women’s Health Can’t Wait,” brings together leaders who are redefining care, research and innovation for women across the Canadian healthcare system. December 12.

- Toronto Together gathers TechTO CEO Marie Chevrier Schwartz, N49P’s Alex Norman and Venue.ink’s Jason Goldlist for an evening of in-depth conversation and networking. January 12.

For more, visit our events page.

Careers: The hottest jobs in tech this week

- ChargeLab, which builds software and hardware for managing EV charging stations, is hiring a business development manager. (Toronto)

- Deep Genomics, which uses AI to speed up the search for new genetic therapies, is hiring for several positions, including senior software engineer (full stack), senior research associate and senior research scientist. (Toronto; Cambridge, Mass.)

- Petal’s online management, communication and planning tools for physicians help reduce admin. They’re hiring for many roles, including medical billing technician, senior developer (full stack) and director of finance. (Multiple cities)

- Haply Robotics, the Montreal-based haptic tech company, is hiring for several positions, including an office and logistics coordinator, a customer applications support engineer and a hardware technician. (Montreal)

- Lillio, a creator of daycare management software, is looking for a sales development representative, a senior software engineer and an account manager. (Remote)

For more, visit our jobs page.

Thanks for reading! We’ll be taking a little break for the holidays. Look for the next issue of The Launch Pad on January 6. Have a restful, refreshing season.

Photo illustration by Stephen Gregory; photos Unsplash, NASA/Solar Dynamics Observatory, NASA

Sign up for our newsletter

MaRS Staff

MaRS Staff